Managed Merchant Services

India’s acquiring landscape remains predominantly local and offline, with digital offline payments gaining traction through innovations such as integrated QR codes and SoundBox solutions. The asset-light nature, affordability, and ease of use of the QR and SoundBox solution makes it attractive for diverse business environments, from large enterprise merchants to small, medium, and micro merchants.

Retailers, who traditionally accept card payments, are now adopting QR codes integrated with SoundBox to enhance their in-store payment infrastructure, streamline checkout processes, and improve customer experience. For small-scale and rural merchants who primarily rely on cash or invoice payments, adopting QR and SoundBox allows them to participate actively in the digital economy, and expand their reach by effectively serving a growing number of customers who prefer cashless transactions.

With the growing adoption of real-time payments and a significant number of merchants yet to be digitized, acquiring has become an attractive yet highly competitive space for banks and FinTechs. However, unlocking the potential of merchant payments proved challenging for acquirers who primarily face three key difficulties:

The emergence of new technology-first players into the acquiring ecosystem has led to the creation of unique collaborative opportunities between traditional banking players and different hardware, software, and distribution firms across industries. This has resulted in various players experimenting with innovative business models to remain competitive in an industry that is transitioning from traditional owned do it yourself acquiring models to partnership with nimble FinTechs.

» Back to Top

Retailers, who traditionally accept card payments, are now adopting QR codes integrated with SoundBox to enhance their in-store payment infrastructure, streamline checkout processes, and improve customer experience. For small-scale and rural merchants who primarily rely on cash or invoice payments, adopting QR and SoundBox allows them to participate actively in the digital economy, and expand their reach by effectively serving a growing number of customers who prefer cashless transactions.

With the growing adoption of real-time payments and a significant number of merchants yet to be digitized, acquiring has become an attractive yet highly competitive space for banks and FinTechs. However, unlocking the potential of merchant payments proved challenging for acquirers who primarily face three key difficulties:

- Growth and Expansion: Success depends on achieving scale closely linked to building robust operations that address diverse merchant needs. Given the geographic expanse of the Indian market, achieving critical mass necessitates significant investments in infrastructure, technology, and partnerships.

- Profitability: Operating a scalable merchant network is resource-intensive, with substantial costs linked to SoundBox estate management and support.

- Merchant Retention: Price sensitivity is a key factor and even small differences in device costs can lead to merchant attrition. Acquirers, need to innovate continuously and layer on added value services to extend merchant lifetime value.

The emergence of new technology-first players into the acquiring ecosystem has led to the creation of unique collaborative opportunities between traditional banking players and different hardware, software, and distribution firms across industries. This has resulted in various players experimenting with innovative business models to remain competitive in an industry that is transitioning from traditional owned do it yourself acquiring models to partnership with nimble FinTechs.

» Back to Top

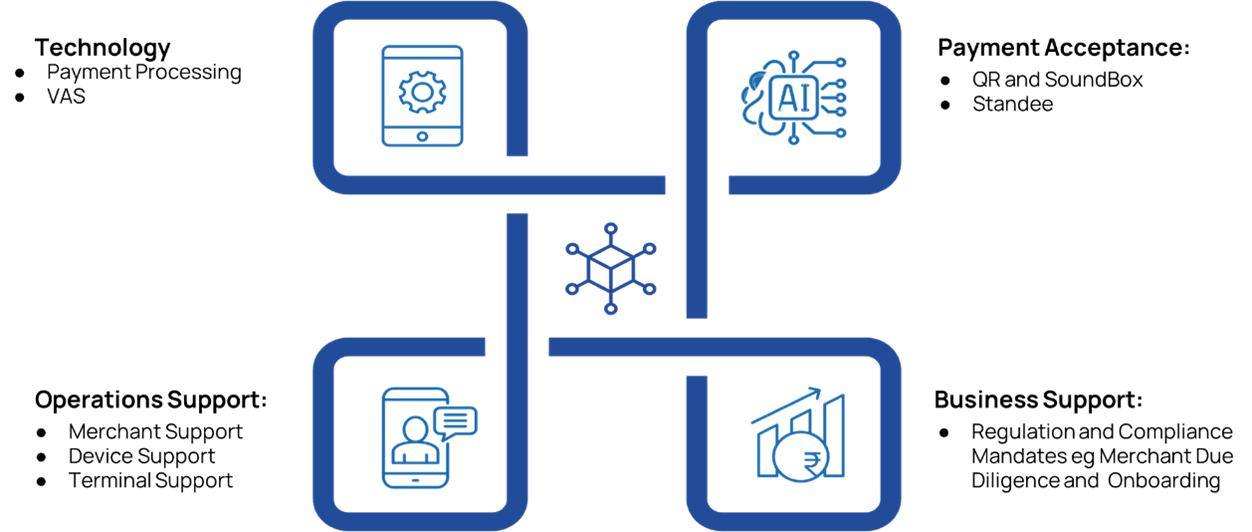

Managed Merchant Service: A Path to Profitable Scale

Acquirers are increasingly turning to managed merchant services model to address operational and cost-related challenges. The merchant services umbrella includes a modular suite of payment-related technology, business, and operations support services. In a market where agility and scale are essential, a managed merchant services model offers acquirers the strategic advantage of focusing on growth without being burdened by day-to-day operational complexities. For example, critical activities such as merchant onboarding, device estate management, transaction processing, settlements, and transaction reconciliation can be simplified through partnering with a Managed Services provider.

Key benefits of Managed Merchant Services

Key benefits of Managed Merchant Services

- Achieve Scale: Expands market coverage and facilitates merchant onboarding without requiring costly increases in operational capacity.

- Control Costs: Assumes responsibility for critical merchant management processes, including onboarding, merchant management, and device management, alleviating operating expenses considerably.

- Manage Innovation: Provides access to the latest technologies and service delivery capabilities without the need for in-house investments.

- Strengthen Compliance: Ensures adherence to regulatory mandates, minimizing compliance risks.

Scope of Managed Merchant Services

As a merchant services provider, NPST is a vital partner that helps acquirers operate and grow their business. NPST facilitates QR payment processing and provides other essential services for businesses.

Essential services offered by a merchant services provider include:

What’s included in Managed Merchant Services

Essential services offered by a merchant services provider include:

- Providing businesses with technology to process payments, manage post-transaction payment processes such as reconciliation and disputes.

- Accepting payments via QR codes and Soundboxes, allowing for seamless transactions.

- Securely managing payment processing and storing payment information to ensure customer data safety.

- Managing operations through merchant support and device management services.

What’s included in Managed Merchant Services

Roles and Responsibilities

- Technology Operations

- Transaction Processing

Offline payments account for three times the volume of online transactions. As transaction volumes grow, many acquiring banks are opting to segregate online and offline payment traffic for better efficiency and management. Additionally acquires are looking to automate reconciliation, dispute management, and chargebacks

NPST provides reliable secure transaction processing by integrating switching capabilities into its technology platform. A dedicated merchant switch maximizes authorization rates, accelerates innovation cycles, and provides acquirers greater control over the merchant experience. - NPST Value Added Services

- Post Transaction Service

NPST Acceptance Solutions can help streamline post-transaction processes and reduce risk and cost by reconciling daily settlements quickly and easily on a transaction level with the ability to automate the process - Risk Monitoring

Protects acquirer’s brand and reputation by monitoring merchants for transaction risks. Automates systems flag unusual transaction spikes in volume and velocity. - Analytics and Reporting

Provides acquirers with a 360-degree view of their business. Detailed insights into transactions, devices, and merchant activities, enabling data-driven decision-making and enhanced operational efficiency. - Content Management

Acquirers can turn payment devices into an integral part of their marketing capabilities. Acquirers can schedule content based on stores, seasons, local events, or other parameters. Additionally, acquirers can retail device estate to FMCG brands for audio announcements, creating a new monetization stream for businesses.

- Post Transaction Service

- Payment Acceptance

NPST provides merchants with the tools and infrastructure required to accept QR payments. With a pan-India network of partners, NPST ensures the efficient procurement and delivery of SoundBox shipments (View Device Ops Section), making it easy to onboard new locations, reduce overall costs, and improve time to market.

Acquirers can choose from a wide range of payment devices, customize services and features to suit their merchants’ needs, and order devices ‘on-demand’ without the need for capital expenditure on inventory stocking.

Business Operations

- Setting Up Offline Acquiring Business

The offline acquiring business is regulated, and NPST helps acquirers set up an effective oversight and governance framework to manage day-to-day operations. The key areas include:- Outsourcing Management:

Ensuring proper management and control of outsourced service providers with a well-defined scope of responsibilities for each stakeholder to ensure accountability and operational integrity - Enterprise Architecture Framework:

Establish an Enterprise Architecture Framework (EAF) that provides a holistic view of technology throughout the acquirers. The EAF is an overall technical design and high-level plan that describes the acquirers’ technology infrastructure, systems’ inter-connectivity and security controls. The EAF facilitates the conceptual design and maintenance of the network infrastructure, related technology controls and policies and serves as a foundation on which acquirers plan and structure system development and acquisition strategies to meet business goals. - Merchant Recruitment and Monitoring:

Developing strategies for effective merchant onboarding, establishing prudent underwriting criteria and procedures, and reinforcing the overall security and trustworthiness of acquiring operations. - Merchant Monitoring:

Conduct effective monitoring of their merchants’ activities to ensure that the merchants are not involved in any fraudulent or illegal activities. - Technology Risk Framework:

Define the Technology Risk Management Framework (TRMF), to safeguard the information infrastructure, systems and data as an integral part of the acquirers’ risk management framework. - Operational Risk Management:

Ensure business continuity by defining the Maximum Tolerable Downtime (MTD) and Recovery Time Objectives (RTO) for each critical business function to ensure reliable services and resilience against potential cyber threats. - Fraud Prevention and Control:

Implementing measures to detect and prevent fraudulent or illegal activities.

- Outsourcing Management:

- Process Documentation

Creating clear process documents that outline compliance requirements, roles, and responsibilities, and keeping acquirers updated on evolving regulations to tailor their compliance efforts. - Audits and Reporting

Additionally, NPST helps establish a framework for process and system audits and timely reporting and escalation of issues that could impact safety, security, or operational reliability of merchant acquiring operations. - Merchant Onboarding

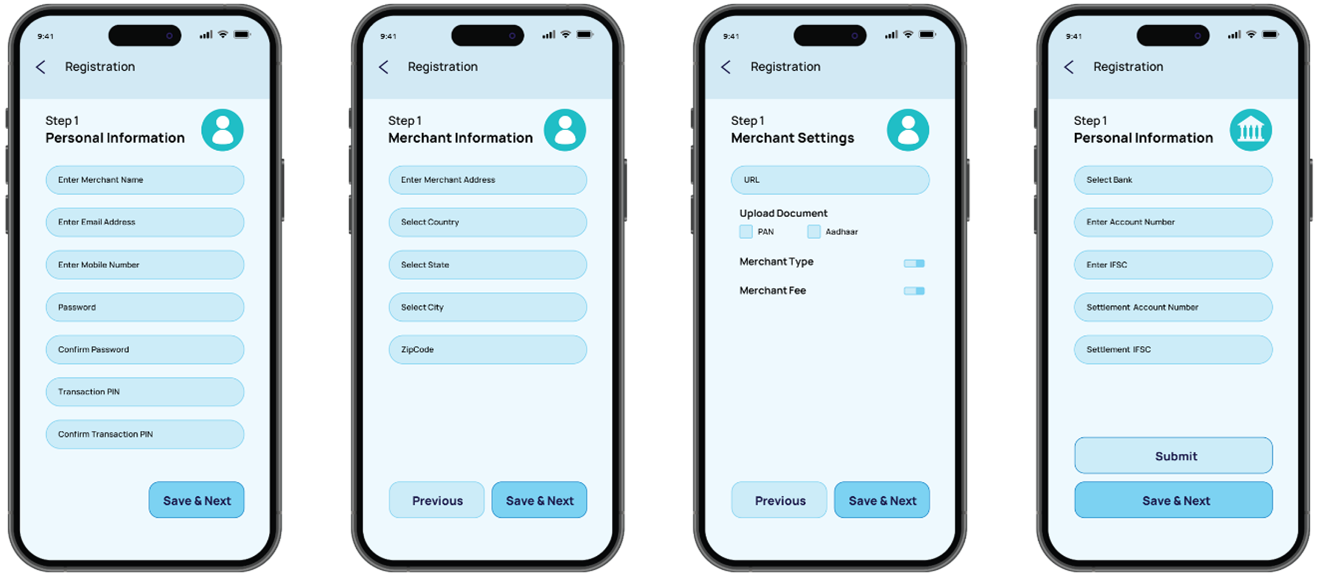

Merchant onboarding presents a significant challenge in balancing a smooth onboarding with a thorough risk assessment against regulatory requirements. Properly managing this process is a crucial fraud prevention measure, as non-compliant onboarding can lead to regulatory scrutiny and increased risk.

Typically, the process entails:- Verifying merchant identities

- Submitting documents

- Conducting background checks

- Performing financial assessments

- Implementing other compliance measures tailored to the business and industry

- Perform KYB Verification

NPST can help digitally onboard new merchants quickly and efficiently. Merchants are provided with an app to upload their documents easily, and the NPST merchant support teams conduct the initial level of verification by cross-verifying documents against reputable databases and through field visits and contact point verification.

During the due diligence process, NPST evaluates risks linked to the merchant based on various parameters including business type, location, and transaction volumes. Once the preliminary checks are complete, NPST forwards the documents to the acquiring or sponsor bank for final merchant verification in line with bank and regulatory guidelines. - Open Merchant Account

A merchant services account establishes a business relationship between acquirers and merchants. For non-bank acquirers, NPST facilitates connections with sponsor banks to streamline the merchant account opening process in line with regulation. The final decision to open the merchant’s current accounts rests with the bank, following the completion of due diligence checks.

- Post-Onboarding Merchant Monitoring

The process doesn’t end with onboarding. NPST ensures ongoing compliance to protect against evolving threats and plays a critical role by continuously reviewing and updating procedures for alignment with evolving regulatory standards. For ongoing merchant monitoring, NPST implements a range of fraud prevention measures, including transaction monitoring for automatically real-time transaction screening, enabling acquirers to quickly identify changes, such as unusual transactions, and spikes in activity.

Operations Support

Service Activation and Deployment

Once onboarded, merchants need to be able to start accepting payments quickly, and this process includes the deployment of QR and Soundboxes, For acquirers maintaining an extensive device estate entails high ongoing operating expenses.

NPST assumes responsibility for Sound Boc estate management overseeing the complete process including order management that includes shipment, inventory, and support. Acquirers gain complete control over their estate reducing the cost of servicing merchants.

The key components include:

The entire process is automated and key elements of this process include:

» Back to Top

Once onboarded, merchants need to be able to start accepting payments quickly, and this process includes the deployment of QR and Soundboxes, For acquirers maintaining an extensive device estate entails high ongoing operating expenses.

NPST assumes responsibility for Sound Boc estate management overseeing the complete process including order management that includes shipment, inventory, and support. Acquirers gain complete control over their estate reducing the cost of servicing merchants.

The key components include:

- Device Sourcing and Procurement: NPST offers streamlined device sourcing and procurement services by providing access to a network of trusted device resellers. This service enables acquirers to reduce the time and resources needed to activate services, as well as minimize friction and operational overheads commonly associated with managing multiple vendor partnerships.

- Logistics and Distribution: Shipping devices across a geographically dispersed merchant base involves careful logistics management to ensure timely delivery, especially as acquirers expand into more regions.

- Inventory Management: Keeping track of inventory to optimize device availability without tying up capital in excess stock.

- Post-Deployment Support: Once devices are in the field, assisting merchants with device setup to replacements, ensuring minimal disruption to payment acceptance.

- Maintenance and Updates: Devices require periodic maintenance, software updates, and occasional repairs adding cost and complexity. NPST provides a 24/7, year-round technical help desk, with tailored service contracts to meet unique business needs. Our support includes SoundBox troubleshooting, repairs, and replacement services for merchants.

- Device Monitoring: Acquirers can stay in complete control of devices. Monitor device heartbeat and proactively report on active and inactive devices.

- Inventory and Install Tracking: Dashboards to help acquirers track installation and inventory status.

The entire process is automated and key elements of this process include:

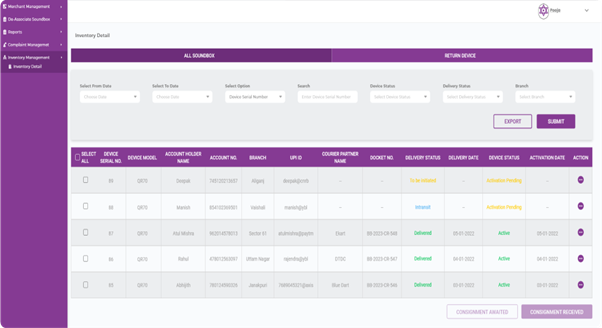

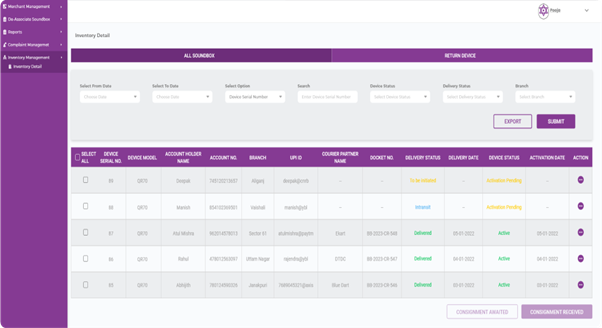

- Order Management: Acquirers place orders through NPST’s dedicated portal, where NPST oversees coordination with shipping vendors to ensure prompt dispatch. Stakeholders can track each order’s status through the portal, providing real-time visibility throughout the process.

- Quality Assurance: Every SoundBox device undergoes rigorous testing before deployment to ensure proper mapping and transaction announcements. The process minimizes returns and replacements, guaranteeing reliable performance and optimal functionality for end users.

- SoundBox and Merchant Mapping: Each SoundBox device is mapped to a SIM and the respective merchant’s Virtual Payment Address (VPA). enabling accurate tracking, to help acquirers keep a clear record of device assignments.

- Shipment Tracking: Acquirers have full visibility into the shipment process via a comprehensive graphical dashboard that displays order details, device IDs, and shipment statuses.

Merchant Satisfaction and Retention

With fierce underbidding and growing price sensitivity, acquirers must prioritize delivering exceptional service and support while managing cost of servicing.

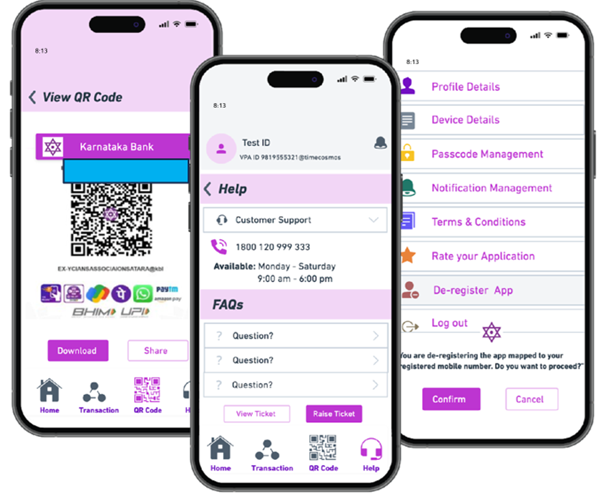

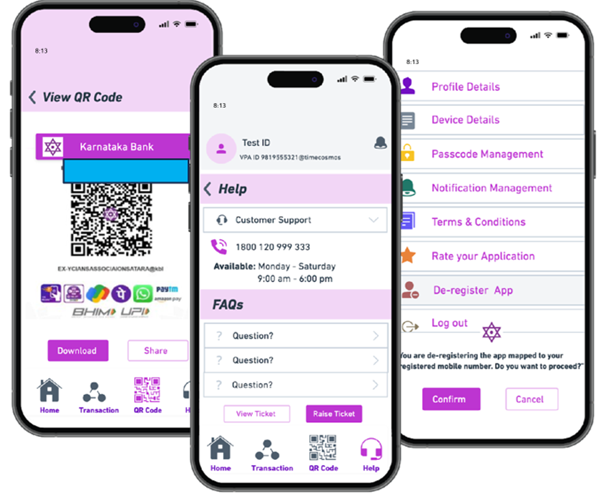

Merchant App

Servicing a widely distributed base of merchants can be costly and often leads to sub-optimal service delivery. The NPST Merchant App user-friendly interface simplifies daily operations, significantly reduces servicing costs, and enhances overall merchant satisfaction. It allows merchants to independently manage accounts, generate QR codes for payments, and access real-time transaction and settlement reports. Merchants can raise queries directly within the app for faster issue resolution and immediate support.

Merchant App

Merchant App

Merchant Analytics

NPST offers merchants detailed access to transactions conducted through their QR codes, enabling them to keep track of payment flows, ensure accurate record-keeping and gain immediate insights into payment trends.

Merchant Training

NPST provides comprehensive training materials to equip merchants with knowledge about QR codes and devices, enhancing their operational efficiency.

Merchant Help Desk

Payment processing has several moving parts, and tech issues may arise. Acquirers want a knowledgeable partner who has their back and can ensure that everything runs smoothly. NPST operates a round-the-clock dedicated help desk to address merchant queries, ensuring uninterrupted support and building trust with acquirers and merchants alike.

How Much Do Merchant Services Cost?

Fee structures for merchant services can work in several ways and vary depending on acquirers’ need. NPST structures fees in multiple ways, including:

» Back to Top

Merchant App

Servicing a widely distributed base of merchants can be costly and often leads to sub-optimal service delivery. The NPST Merchant App user-friendly interface simplifies daily operations, significantly reduces servicing costs, and enhances overall merchant satisfaction. It allows merchants to independently manage accounts, generate QR codes for payments, and access real-time transaction and settlement reports. Merchants can raise queries directly within the app for faster issue resolution and immediate support.

Merchant Analytics

NPST offers merchants detailed access to transactions conducted through their QR codes, enabling them to keep track of payment flows, ensure accurate record-keeping and gain immediate insights into payment trends.

Merchant Training

NPST provides comprehensive training materials to equip merchants with knowledge about QR codes and devices, enhancing their operational efficiency.

Merchant Help Desk

Payment processing has several moving parts, and tech issues may arise. Acquirers want a knowledgeable partner who has their back and can ensure that everything runs smoothly. NPST operates a round-the-clock dedicated help desk to address merchant queries, ensuring uninterrupted support and building trust with acquirers and merchants alike.

How Much Do Merchant Services Cost?

Fee structures for merchant services can work in several ways and vary depending on acquirers’ need. NPST structures fees in multiple ways, including:

- Flat monthly rates

- Per transaction fees

- Tiered pricing structures, with different features and services included at different price points

Final Word

The offline acquiring business is regulated, and NPST helps acquirers set up an effective oversight and governance framework to manage day-to-day operations. The key areas include: Outsourcing Management: Ensuring proper management and control of outsourced service providers with a well-defined scope of responsibilities for each stakeholder to ensure accountability and operational integrity Enterprise Architecture Framework: Establish an Enterprise Architecture Framework (EAF) that provides a holistic view of technology throughout the acquirers. The EAF is an overall technical design and high-level plan that describes the acquirers’ technology infrastructure, systems’ inter-connectivity and security controls. The EAF facilitates the conceptual design and maintenance of the network infrastructure, related technology controls and policies and serves as a foundation on which acquirers plan and structure system development and acquisition strategies to meet business goals. Merchant Recruitment and Monitoring: Developing strategies for effective merchant onboarding, establishing prudent underwriting criteria and procedures, and reinforcing the overall security and trustworthiness of acquiring operations.

Our All-in-One Stack goes beyond the offerings of standalone QR and SoundBox providers, delivering a comprehensive suite of technology and business solutions that allow acquirers to scale profitably.

Currently supporting QR and SoundBox operations across 700 locations, NPST adheres to the highest standards through rigorous due diligence, ensuring:

» Back to Top

Our All-in-One Stack goes beyond the offerings of standalone QR and SoundBox providers, delivering a comprehensive suite of technology and business solutions that allow acquirers to scale profitably.

Currently supporting QR and SoundBox operations across 700 locations, NPST adheres to the highest standards through rigorous due diligence, ensuring:

- Capacity and Capability to meet operational demands effectively.

- Technology and Domain Expertise for cutting-edge, reliable solutions.

- Financial Strength and Business Reputation for stability and trustworthiness.

- Regulatory Compliance with all relevant laws and policies.

- Risk Management and Internal Controls, including robust IT security and business continuity plans.

» Back to Top

Explore More

We empower banks and payment aggregators to achieve success at every step of the transaction journey