Bharat Bill Payment System (BBPS) is fuelling the adoption of digital payments in India by addressing one of the most basic transactional consumer needs. As an interoperable bill payment platform, BBPS has brought multiple billers under a single platform, eliminating the need to individual tie-ups with multiple banks and reducing operational complexities. The open network allows billers to tap into a wider consumer base and digitize collections.

Consumers benefit from the flexibility of paying their bills through diverse digital interfaces—such as UPI, internet banking, and credit cards—ensuring a seamless and convenient payment experience.

Consumers benefit from the flexibility of paying their bills through diverse digital interfaces—such as UPI, internet banking, and credit cards—ensuring a seamless and convenient payment experience.

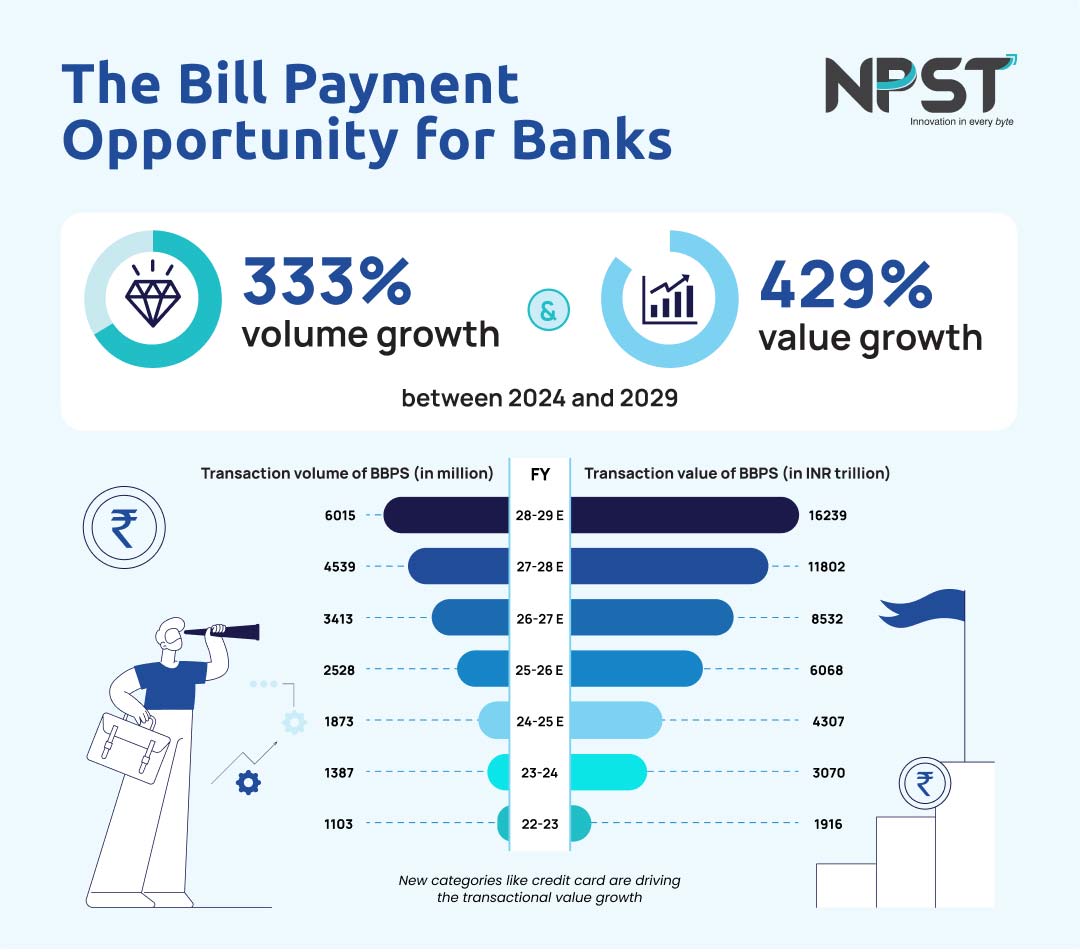

Currently, BBPS supports over 150 channels and has onboarded over 21,000 billers across 20+ categories, serving over 102 million consumers. According to PWC, transaction volumes are anticipated to surge by 338%, growing from 1.8 billion to 6 billion transactions between 2024 and 2029.

Challenges of Commoditization

However, this rapid expansion also presents challenges. The standardized nature of BBPS has led to commoditization, with most banks offering nearly identical services. To stand out and attract billers and consumers in this largely utility-driven market, bill payment technology vendors like NPST are embedding AI into critical bill payment processes.

Use cases include optimize collections for billers and enhance customer service models, adding value that extend beyond the basic utility of bill payments.

Maximizing Collection Efficiency

Billers offering postpay services face challenges in identifying default patterns, resulting in substantial revenue losses—estimated between 15% and 20% across various billing categories, according to a 2022 report by CRISIL. AI can help with collections in several ways:

- Analyzing Payment Patterns: AI-powered bill payment solutions can proactively detect the likelihood of defaults and improve collections. Advanced machine learning algorithms analyze customer payment patterns and the variables that lead to overdue balances. By leveraging this data, machine learning models can identify patterns and correlations that forecast the likelihood of bill defaults for each customer. For example, if a customer has a history of late payments, the system can proactively flag such behavior. The insights are invaluable to billers as it enables them to minimise defaults and bad debts.

- Customer Profiling for Targeted Interventions Banks can also profile customer transactional patterns into segments such as Timely Transactors, Occasional Defaulters, and Habitual Defaulters. Billers can act on this information to implement targeted interventions for those at risk of default. For instance, a utility company might reconfigure payment alerts to remind occasional defaulters to avoid fines.

- AI-Powered Nudges: AI-powered nudges mapped to customer transactional patterns can prompt payments and foster strong customer relationships. By analyzing communication strategies around billing, billers can identify the most effective reminders for soliciting on-time payments. For example, do customers respond better to reminders one month before the due date or two weeks prior? Insights like these can significantly improve payment timeliness.

-

Intelligent Cashback Programs: Many billers may lack the advanced analytical tools to run effective incentive programs, such as early discounts or cashback initiatives. Reporting interfaces and biller dashboards integrated into bill payment software can assist in analyzing payment data effectively. Some bill payment technology vendors such as NPST offer cashback modules built into the bill payment platform that can help them automate and manage the lifecycle of such programs, enabling them to launch effective promotional initiatives.

Referral and cashback programs have proven effective for banks in promoting credit card products. Banks can leverage transactional data from the Bill Payment system to offer cashback on utility payments through credit cards, attracting high-net-worth customers. For example, Paise Bazar offers a credit card market for utility payments in India. Additionally, this data can facilitate instant credit through UPI for specific biller categories, such as education fees, which is currently the second-highest value category, with an average transaction size of ₹15,000. Although these programs operate outside the bank’s bill payment system, they can significantly help banks differentiate themselves in a commoditized market.

Transforming Customer Experience with AI-Driven Chatbots

According to the RBI’s Banking Ombudsman Report 2021-22, digital transaction-related complaints comprised 42.12% of total customer grievances, many related to delayed bill payments or billing inaccuracies. AI-powered assistants available 24/7 can offer immediate support for a range of issues. For example, if a customer’s money is debited but the bill shows unpaid, the chatbot can instantly check the transaction status and provide real-time updates. By delivering immediate answers to common inquiries, the Bill Direct Chatbot can quickly alleviate customer concerns while reducing the burden on customer service representatives.

In Conclusion

The bill payment market is still in its early growth stages, and as more banks, billers, and consumers come on board, the demand for qualitatively superior services becomes increasingly essential. By prioritizing enhanced offerings for billers and customers, banks can position themselves as preferred partners in this evolving landscape.

To achieve this, it is crucial for banks to collaborate with vendors that possess strong roadmaps in analytics and AI-embedded solutions. NPST is actively working in these areas to help banks solidify their position in this fast-growing market.

NPST Bill Direct, an AI-based bill payment and presentment solution, is transforming how banks manage bill payments. By leveraging AI, banks can significantly improve collection rates for billers, boost operational efficiency, and enhance the overall customer experience.

Explore More

We empower banks and payment aggregators to achieve success at every step of the transaction journey