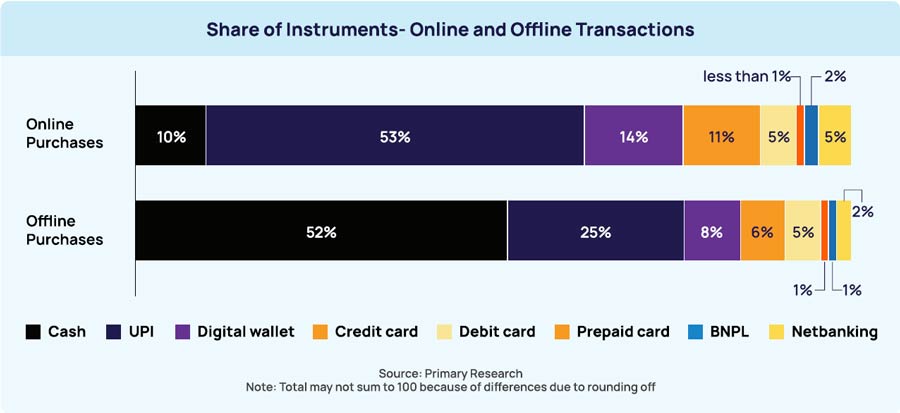

Over the past decade, India’s digital payment landscape has undergone an exponential transformation, with Unified Payments Interface (UPI) playing a pivotal role. According to an AT Kearney report on “How India Pays,” recent consumer surveys reveal notable shifts in payment preferences:

90% of consumers now prefer digital payments for online purchases, reflecting a clear shift towards convenience and efficiency.

50% of consumers use digital payments for offline purchases, signaling a convergence between online and offline transaction behaviour.

85% of respondents prefer using digital payments for discretionary purchases, such as electronics, clothing, and footwear.

This shift in consumer behaviour highlights UPI’s growing dominance, particularly as it gains acceptance across diverse geographic and income segments. In fact, digital payments account for 65% of transactions in smaller towns and 75% in larger cities, signifying broad adoption nationwide.

Credit Cards in High-Value Transaction

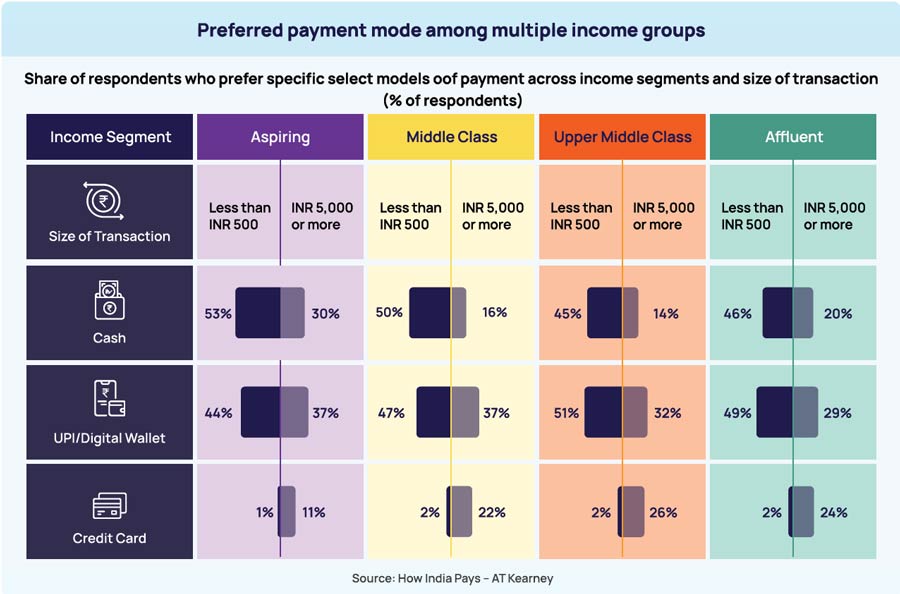

Despite UPI’s dominance, credit cards continue tohold sway over high-value purchases. This is largely attributed to their greater purchasing power and attractive perks, such as cashback, rewards, and loyalty points.

However, with only around 102 million credit cards in circulation, penetration remains relatively low. Considering India’s burgeoning middle class, with approximately 432 million consumers and household incomes ranging between ₹500,000 and ₹3,000,000 annually, there exists a vast untapped market for credit access.

The limited reach of credit cards, particularly, highlights a significant opportunity to expand credit access.

The Rise of Pay Later Services

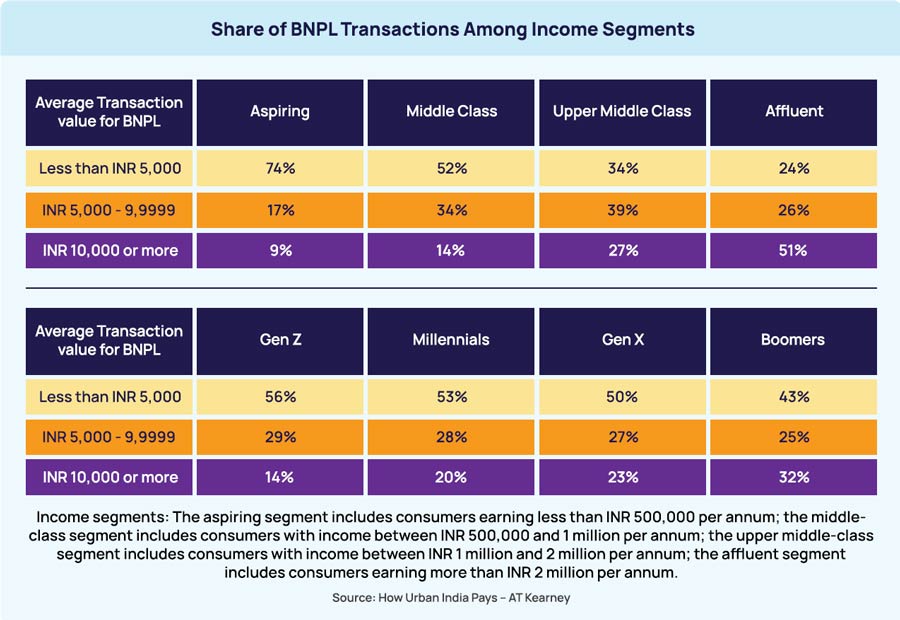

Consumer finance and non-banking financial companies (NBFCs) have been quick to capitalize on the limited penetration of credit cards.Pay Later products offer near-instant approval, flexibility, and access to credit without the need for traditional credit cards—making them especially appealing to younger, tech-savvy consumers.

In India’s top six metros, 40% of consumers have already embraced Pay Later services, while smaller cities and towns, where 20% of respondents are still unaware of Pay Later, present a ripe market for expansion.

Why Pay Later is Popular?

- Eliminates Need for Credit Cards: Consumers can access BNPL services without needing traditional credit lines, making it accessible to a broader audience.

- Instant Approval: BNPL products provide fast, convenient credit approval, which aligns with today’s demand for instant, hassle-free financial services.

- Flexibility: BNPL allows consumers to pay in instalments without the high interest rates typically associated with credit cards and loans.

This model has enabled fintechs and NBFCs to establish strong relationships with retailers and consumers by embedding credit directly into the checkout process,driving higher conversion rates and increased spending, reshaping consumer habits and providing these players with a competitive edge.

UPI-Linked Credit: A Gateway for Banks

As UPI has already transformed payment habits in India, the next natural evolution lies in UPI-linked Pay Later options. These services allow consumers to access pre-approved credit lines directly through their UPI apps, offering unparalleled convenience. Specifically designed to serve customers with loan requirements below ₹50,000, UPI-linked credit lines provide a low-cost, accessible alternative to traditional credit cards.

This solution is particularly promising given the low penetration of credit cards—only 10% of consumers currently own a credit card in India. With the vast middle class eager for flexible financing options, UPI-linked credit products present a massive untapped market for banks.

How Can Banks Lead the Pay Later Market?

Banks are uniquely positioned to dominate the Pay Later market by leveraging their existing infrastructure, customer trust, and advanced financial capabilities.

- Leverage Trust and Relationships: Banks have a competitive advantage in establishing trust and customer relationships. By offering Pay Later within existing apps, such as UPI or Banking SuperApp they can provide a seamless experience for users already engaged with their digital platforms.

- Harness Data for Personalized Offers: Banks have access to detailed customer data, enabling them to extend responsible, tailored credit, reducing the risk of defaults.

- Offer Flexible Repayment Plans: One of the key appeals of Pay Later services is installment flexibility. Banks can attract customers by offering interest-free or low-interest repayment plans, enhancing affordability and enabling better financial management for consumers.

- Partner with Merchants for POS Integration: Banks can further strengthen their Pay Later offerings by partnering with merchants. By embedding Pay Later options at the point of sale, , banks drive adoption and help merchants increase sales while offering a convenient checkout experience.

- Implement Advanced Risk and Fraud Management: AI-powered risk management tools enable banks to minimize default rates while offering credit to the right customers, ensuring that Pay Later services are sustainable and scalable.

- Ensure Regulatory Compliance: anks are well-equipped to ensure compliance with regulatory standards, By prioritizing security and regulation, banks can distinguish themselves from new entrants in the Pay Later market.

- Offer Rewards and Incentives: Banks can incentivize consumers to use their Pay Later offerings by introducing reward programs, cashback, and loyalty points. This drives adoption and fosters loyalty, ensuring that customers continue using the service over competitors.

Monetizing UPI-Linked Credit

The National Payments Corporation of India (NPCI) has introduced new guidelines, effective from October 16, 2024, aimed at encouraging banks to adopt UPI-linked credit solutions. Under the new framework, an interchange fee of 1.2% will be charged on transactions made via pre-approved UPI credit lines. This fee is paid by the acquiring bank (the bank processing the merchant’s payments) to the issuing bank (the bank offering the credit).

- Increased Revenue: Interchange fees on UPI credit transactions provide a consistent source of income, particularly as UPI usage grows.

- New Customers: UPI-linked credit lines make credit accessible to a wider demographic, particularly those without access to traditional credit cards.

- Merchant Adoption: With lower fees than traditional credit cards (RuPay at 1.6% and other cards up to 3.5%), merchants are likely to embrace UPI credit solutions, driving further adoption.

Additionally, banks can generate revenue from late payment interest fees, further boosting profitability.

The Threat of Cannibalization

One concern for banks is the potential cannibalization of existing credit card usage. As UPI-linked credit becomes more popular, some consumers may shift away from credit cards to take advantage of the lower fees and greater flexibility. However, this risk can be offset by the wider reach and larger number of consumers availing of UPI-linked credit.

Act Now or Fall Behind

As fintechs and NBFCs continue to expand their footprint in the Pay Later market, banks cannot afford to remain passive. By leveraging UPI-linked credit solutions, banks can claim their share of this fast-growing market. NPST’s recently launched PayJoy solution enables banks to extend UPI-linked pre-approved credit lines to their customers. This offers a flexible, convenient solution for consumers while unlocking new revenue streams for banks.

Through PayJoy, banks can integrate seamlessly with UPI to provide real-time credit access, offering customers greater purchasing power without the need for physical credit cards. This not only empowers consumers but also positions banks as key players in the Pay Later ecosystem, driving financial inclusion and market competitiveness.

Explore More

We empower banks and payment aggregators to achieve success at every step of the transaction journey