As we approach 2025, the digital payments landscape continues to evolve at an unprecedented pace. These advancements are not just technological; they signify a paradigm shift in how we interact with money, businesses, and each other. UPI, a strong driver of this transformation, facilitated over 15,547 crore transactions worth ₹223 lakh crore from January to November 2024 alone, showcasing its pivotal role in reshaping India’s financial ecosystem.

This dynamic growth is driving three key priorities for paytech leaders: expanding market share, achieving sustainable profitability, and ensuring robust governance in areas like security and compliance. Here’s a closer look at the trends shaping the future of payments in the new year.

1. Embedded Payments: The Invisible Revolution

The Unified Payments Interface (UPI) ecosystem in India has evolved beyond a payment rail, becoming an omnipresent network that transforms connected devices into potential payment endpoints. This shift marks a new era in digital payments, where transactions seamlessly integrate into daily life through device-driven solutions.

Automotive manufacturers are already embedding UPI capabilities for automated toll payments, fuel purchases, and parking fees. In the near future, everyday devices—like smartwatches and home appliances—will initiate and complete payments autonomously. Imagine a refrigerator reordering groceries or a smart home system managing utility payments without human intervention.

This evolution extends beyond convenience, reshaping consumer behavior and merchant operations by eliminating payment friction. As businesses adopt UPI-enabled solutions, payments are becoming invisible yet indispensable, fundamentally transforming how India transacts in the digital age.

2. Credit Lines on UPI

The integration of retail credit into UPI represents a transformative shift in India’s payments landscape. As NPCI aims to achieve 100 billion monthly UPI transactions, embedding instant credit capabilities will redefine consumer spending. Even a modest credit enablement of 5-10% of UPI transactions could significantly impact the market.

By 2025, pre-approved credit lines accessible via UPI apps will eliminate the need for traditional credit cards. This frictionless access to credit at the point of sale, coupled with micro-credit solutions for everyday purchases, will revolutionize retail financing. With regulatory frameworks evolving to ensure consumer protection, UPI credit is set to become the new standard for digital lending.

3. Interoperability of Internet and Mobile Banking

The interoperability of Internet banking and mobile banking channels will be another exciting development in 2025. Currently, Internet banking transactions processed through payment aggregators are not interoperable, requiring banks to individually integrate with each PA of different online merchants.

The upcoming Internet Banking Interoperability initiative, led by NPCI Bharat BillPay (NBBL), eliminates the need for separate bank-PA integrations, creating a unified framework that will streamline merchant settlements, reduce technical complexity, and enable seamless fund transfers.

4. RegTech for Real-Time Fraud Management

The sharp rise in payment fraud—up 70.64% to ₹2,604 crore by March 2024, according to RBI data—underscores the urgent need for advanced security measures. As transaction volumes surge, particularly in merchant acquiring, the ecosystem is pivoting to sophisticated fraud prevention strategies.

By 2025, the integration of AI and machine learning will enable real-time transaction monitoring and automated risk scoring. Advanced regulatory technology (RegTech) will transform compliance processes through perpetual KYC and automated reporting. This proactive approach will strengthen payment security while maintaining transaction efficiency, ensuring the ecosystem remains resilient and trustworthy.

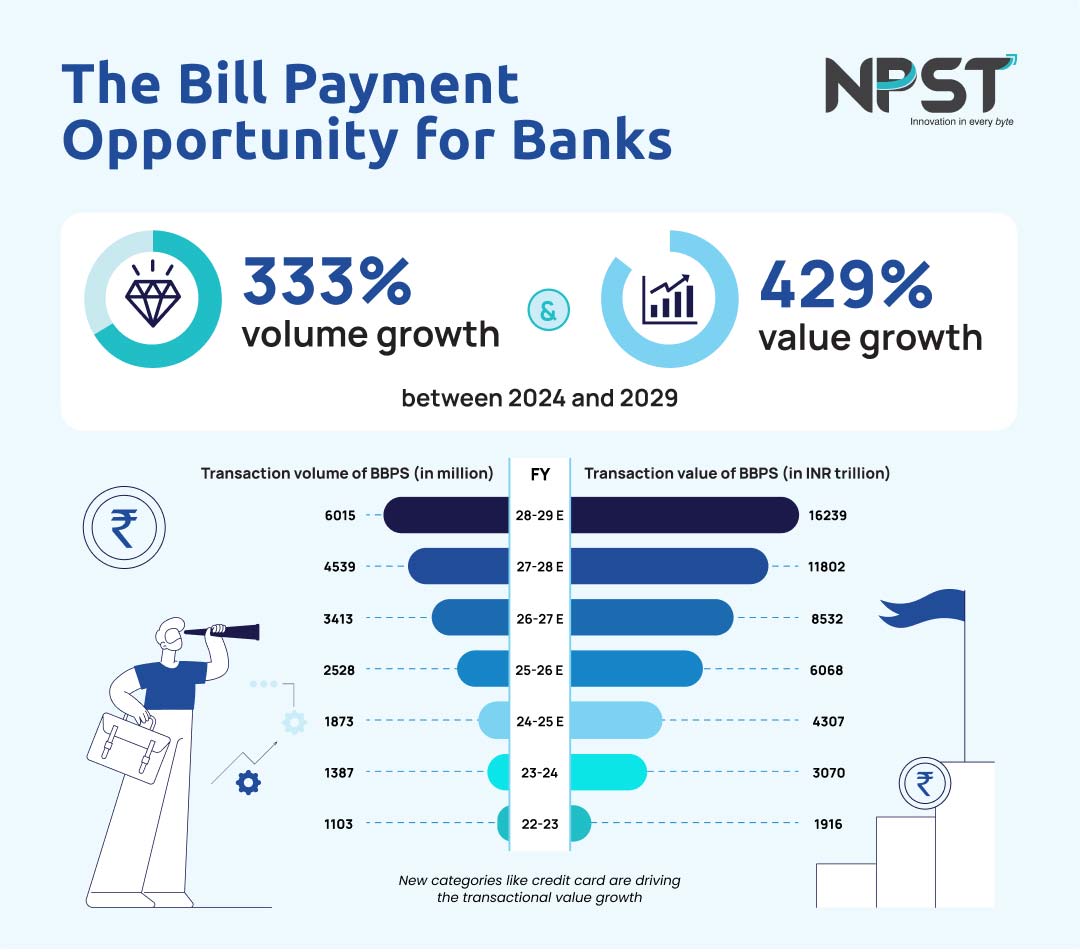

5. The B2B Revolution in Bill Payments

Bharat BillPay’s expansion into B2B payments marks a significant leap forward. By enabling businesses to register as billers, the platform offers a suite of services, including seamless onboarding, invoice management, and automated payment reminders.

This multi-modal payment infrastructure—spanning UPI, net banking, cards, and wallets—ensures guaranteed settlements and improves liquidity management for businesses of all sizes. As a result, the B2B payments ecosystem is becoming more efficient and accessible, supporting growth across industries.

6. The Rise of Digital Currencies

Central Bank Digital Currencies (CBDCs) are transitioning from pilot programs to full-scale implementations, with major economies like the EU, China, and India leading the charge. In India, the Reserve Bank of India (RBI) has successfully onboarded five million users and 16 banks in its CBDC pilot, taking a deliberate approach to nationwide rollout. Notably, the initiative to test CBDC for employee allowances signals a move toward practical adoption.

CBDCs promise to enhance efficiency and inclusivity by providing government-backed digital currencies that streamline transactions. They will enable faster, cheaper, and more secure cross-border payments, reducing reliance on traditional systems like SWIFT. Integrating CBDCs into existing payment infrastructures will facilitate smoother international trade, delivering significant benefits to globally engaged businesses.

Conclusion

India’s digital payment volumes grew by 42% year-over-year in FY23-24 and are projected to triple by FY28-29, according to PwC. The trends shaping 2025—digital currencies, IoT payments, UPI credit lines, and advanced security protocols—go beyond technological evolution. They represent a profound shift in how we use money and engage with markets.

As these innovations unfold, their design must remain human-centric, enhancing lives and creating equitable opportunities. By adopting a proactive and responsible approach, businesses and policymakers can harness these trends to drive a more inclusive and efficient financial future.