Interoperability has become an essential element in creating accessible, inclusive payment ecosystems around the world. In India, this vision is realized through the Unified Payments Interface (UPI), setting a global standard for real-time payments.

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has fundamentally changed how transactions occur in India. The real-time payment network enables seamless transfers between account holders across banks using a standardized framework, eliminating the barriers that once made digital payments cumbersome. In the past decade, its Universal accessibility has led to a dramatic decline in cash transactions, cementing India’s status as a digital-first economy.

The benefits of this shift extends to a broad spectrum of service providers, including banks, payment networks, and processors. Merchants, for instance, can now accept payments using QR codes from any UPI app linked to a bank account. This standardization enhances operational efficiency and promotes both innovation and financial inclusion, crucial drivers of India’s burgeoning payment ecosystem.

Challenges in Net Banking

Despite UPI’s success, India’s broader digital payment infrastructure still faces several challenges, particularly with net banking. Internet and mobile banking are among the oldest modes for online merchant payment transactions and a preferred channel for payments such as income tax, insurance premiums, mutual fund payments, and e-commerce transactions. While net banking volumes have surged—420 million transactions amounting to ₹100 lakh crore in October 2024 alone—the lack of interoperability remains a key bottleneck, limiting the scalability and efficiency of digital payments.

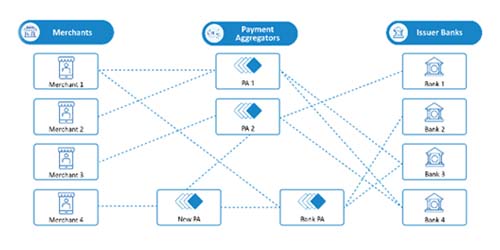

The current model for net banking relies on a system of bilateral agreements, where each bank and payment aggregator (PAs) enter into a relationship for processing online transactions. For instance, when a customer shops on an online marketplace and proceeds to pay, they are shown all available payment options. If their bank is not integrated with the payment aggregator, the bank’s name will not appear under the net banking option, preventing the customer from completing the transaction through that method.

Given the vast number of banks and payment aggregators, one-to-one integration models are inefficient and increase integration overheads, making it challenging for smaller players to compete.

The lack of interoperability introduces additional challenges. Settlement processes are inherently non-standardized and often take 1-3 days to complete, creating cash flow challenges for merchants and exposing them to higher settlement risks. Additionally, the lack of transparency in resolving transaction failures results in prolonged resolution cycles, discouraging customers from choosing net banking as a preferred payment method.

The Path Forward: Implementing Interoperability

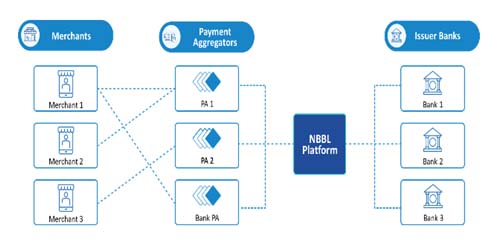

Recognizing these issues, the Reserve Bank of India (RBI) has granted formal approval for the interoperability of net banking. The initiative will enable banks and payment aggregators to connect directly to a central payment routing clearing and settlement scheme facilitating transactions across the ecosystem. In contrast to the current bilateral integration approach, the “connect once, transact with many” model optimizes integration overhead for smaller banks and aggregators. Ultimately, the model aims to level the playing field for smaller banks, payment aggregators, and merchants, unlocking new opportunities for collaboration, scalability, and innovation.

Current Bilateral Model

Proposed Interoperable Model

Principles of an Interoperable Switch

To ensure the long-term success of payment systems, they must be designed with several core principles in mind:

- Interoperability: Streamlined integration for banks and payment aggregators.

- Mobile-First Approach: Enabling transactions through mobile banking apps.

- Standardized Real-Time Settlement: Ensuring faster merchant payments and reducing risks.

- Zero Fraud: Robust fraud prevention built into the system.

- Zero Downtime: Ensuring 24/7 platform availability.

- Minimized Failed Transactions: Enhancing dispute resolution and monitoring.

- Configurability: Low-code integration for ease of implementation.

- Scalability: Supporting growing adoption with seamless user experiences.

Role of Banks and Payment Aggregators

Banks and payment aggregators must deploy a payment switch to interconnect with centralized schemes for seamless interoperability. Payment aggregators also benefit from the flexibility to connect directly to the central platform, enabling faster time-to-market and more efficient collaboration between all players in the ecosystem.

For banks and aggregators, outsourcing the switch to technology service providers like NPST can alleviate infrastructure burdens. With a well-designed payment switch, banks and payment aggregators can ensure optimal fraud detection, transaction monitoring, and regulatory compliance, while also streamlining reconciliation and dispute management processes.

Evaluating a Switch Provider

When assessing a payment switch, several attributes must be considered, beyond basic processing functionalities. These include:

Manage Risk and Fraud

As Internet banking processes higher transaction volumes, real-time fraud detection capabilities, built into the switch, provide an essential compliance and security layer for banks and payment aggregators to combat emerging threats. While major banks rely on robust Fraud Risk Management (FRM) systems, mid-sized and smaller payment aggregators face significant challenges due to limited expertise and resources. For these players, integrated fraud prevention mechanisms within payment platforms offer a scalable and cost-effective solution.

- Robust Protection: Ensure strong fraud defenses on both the issuer and acquirer sides.

- Improved Accuracy: Enhance fraud detection to minimize losses and false positives while controlling deployment costs.

- Advanced Algorithms: Implement machine learning models that go beyond rules-based systems to analyse large datasets, uncover implicit patterns, and assign risk scores based on factors like transaction amounts, merchant type, merchant behavior, customer behaviour, and geolocation.

- Seamless Updates: Enable real-time updates of fraud detection algorithms without causing system downtime.

- Performance Assurance: Maintain consistent throughput and low latency during peak traffic to meet stringent SLAs.

- Data Security: Ensure comprehensive protection for personally identifiable information (PII).

Secure Transactions

Compliance with frameworks like PA-DSS and PCI-DSS is so important—it helps protect sensitive payment information and keeps vulnerabilities in check. Beyond these standards, given the volume of Personally Identifiable Information (PII) involved in processes like customer registration and payments through Internet Banking Systems (IBS), banks and merchant-PAs must be compliant with Regulations like the Information Technology Act require explicit consent from customers before sharing their data, emphasizing the importance of transparency and respect for privacy.

Reconcile and Settle Transactions

An effective payment switch allows financial institutions to automate three-way reconciliation between the central scheme, core banking system, and payment records, significantly reducing administrative overhead. The level of automation may vary between technology providers. The switch should automatically compare transaction records from the central payment system and those from the issuing and acquiring institutions to identify discrepancies. This facilitates quicker dispute resolution and faster settlement of funds. Additionally, the process should calculate net-off totals and post them to the general ledger accounts, ensuring accurate financial management and streamlining the reconciliation process.

Enable Informed Decisioning

Advanced analytics capabilities allow stakeholders to monitor transaction trends and performance metrics. These insights must help banks refine fraud detection mechanisms, optimize service experience, and support informed decision-making for continuous improvement.

Assured QoS

High throughput and low latency are critical for handling growing transaction volumes. Modern payment switches leverage microservices architectures, allowing horizontal scaling and fault isolation. This ensures minimal service disruptions and maintains average processing times under 30 seconds, enhancing user satisfaction and trust.

Microservices also support independent deployment and scaling of individual services, optimizing resource usage and facilitating rapid error resolution without affecting the entire system.

In Conclusion

As banks and payment aggregators prepare for an interoperable future, implementing scalable, secure, and real-time processing capabilities becomes imperative. By leveraging solutions like NPST’s offerings, financial institutions can expand their digital footprint, unlock growth opportunities, and stay competitive in the evolving financial services landscape.

For more information on interoperability in Internet Banking, connect with us at sales@npstx.com

Explore More

We empower banks and payment aggregators to achieve success at every step of the transaction journey