In a post digital world, banks are looking to offer services beyond traditional core banking services. The future of consumer engagement lies in integrating products and services that simplify daily life—accessible through a unified app.

Recognizing this trend, NPST’s customer, India’s largest public sector bank, has embraced a proactive, needs-driven approach to customer engagement. Moving beyond the traditional ‘product-push’ mentality, the bank has established an expansive ecosystem of partners to seamlessly integrate disparate aspects of a customer’s financial life, bringing together convenience, functionality, and value into their financial journeys. Through its Super App, powered by NPST’s Digital Engagement Platform, the bank offers over 400 services to meet the evolving needs of 21 million active users, setting new benchmarks for customer engagement in the digital age.

Riding on India’s Travel Boom

Travel is increasingly central to consumers’ lives, and India’s expanding travel ecosystem, fuelled by digital adoption, offers a prime opportunity to banks to deepen consumer relationships. For example, Indian millennials (aged 28-43) spend an average of ₹5.04 lakh annually on travel, making them a prime audience for travel-centric banking services. According to Collinson International’s 2024 Travel Benefits and Customer Engagement Report, this generation leads travel spending compared to other age groups. Additionally, with over 6.7 billion passenger journeys made on Indian Railways in FY24, and 80% of bookings conducted online, the intersection of travel and technology is reshaping consumer behaviour.

| Generation | Birth Years | Current Age (2024) | Average Annual Travel Spending |

|---|---|---|---|

| Millennials | 1981-1996 | 28-43 years | ₹5.04 Lakh |

| Gen Z (Zoomers) | 1997-2012 | 12-27 years | ₹2.19 Lakh |

| Gen X | 1965-1980 | 44-59 years | ₹2.56 Lakh |

| Boomers (Baby Boomers) | 1946-1964 | 60-78 years | ₹2.17 Lakh |

| Source Collinson International | |||

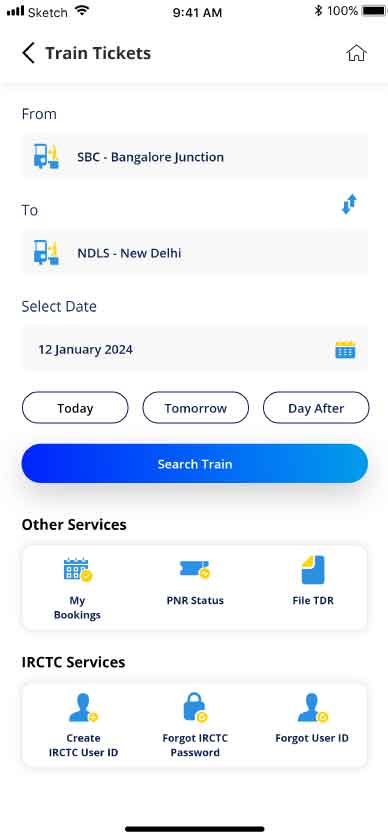

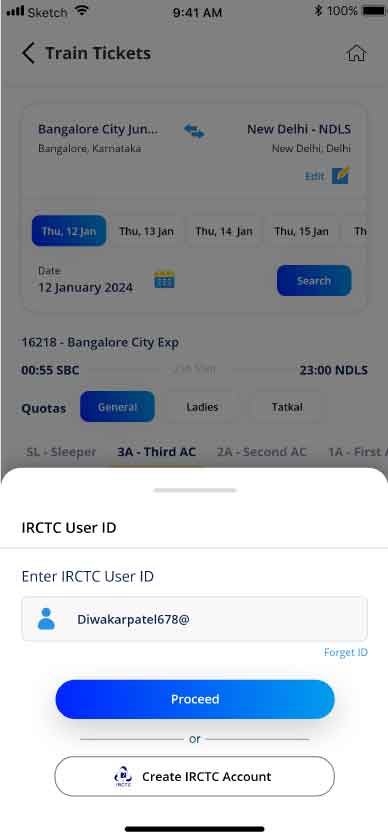

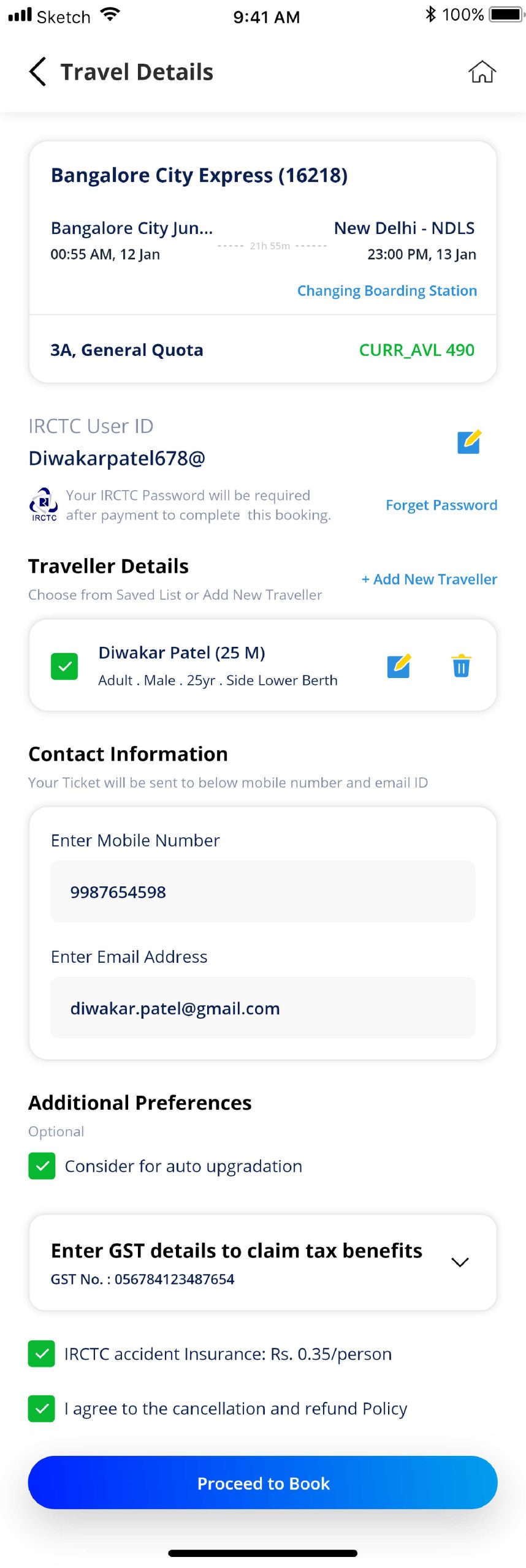

How the Service Works?

NPST, has integrated IRCTC services with the bank’s SuperApp, providing a seamless experience for customers. Customers can now book train tickets seamlessly within the banking app, saving time and eliminating the hassle of switching between platforms. Customers can personalize their travel by selecting locations, preferred berths, meal options, and travel insurance, while the app retains preferences and payment details for faster, hassle-free bookings. In addition to train bookings, the app offers hotel and cab reservations, creating a one-stop solution for all travel needs. Refunds are processed directly into bank accounts, ensuring a smooth and stress-free experience.

User Experience

Customer Services

Booking and Ticketing Services

- Train Enquiry: Searc for train schedules and details.

- Book Seat: Book a seat for a train journey.

- PNR Status: Check status of booked tickets.

- Cancel Ticket: Cancel an existing train ticket.

- Train Route: View route or stops of a specific train.

- Change Boarding Point: Modify the boarding station for an already booked ticket.

Account and User Management Services

- Forgot IRCTC User Id: Recover forgotten IRCTC user ID.

- Forgot IRCTC Password: Reset forgotten IRCTC account password.

- Create IRCTC User Id: Register for a new IRCTC account

Booking History

- My Bookings: View current and past bookings or ticket history.

- Enable/Disable Train Tickets: Manage the visibility or availability of train ticket booking options within the app.

Low Code Integration

NPST has seamlessly integrated IRCTC services into the bank’s SuperApp, allowing customers to book train tickets, reserve hotels, and manage their travel directly from the app. This was achieved in just 12 weeks through its low-code platform, ensuring a quick and efficient rollout.

The NPST SuperApp, powered by its Digital Engagement platform, integrates effortlessly with the Indian Railway Catering and Tourism Corporation (IRCTC) platform through the API-Gateway.

Customer Interaction:

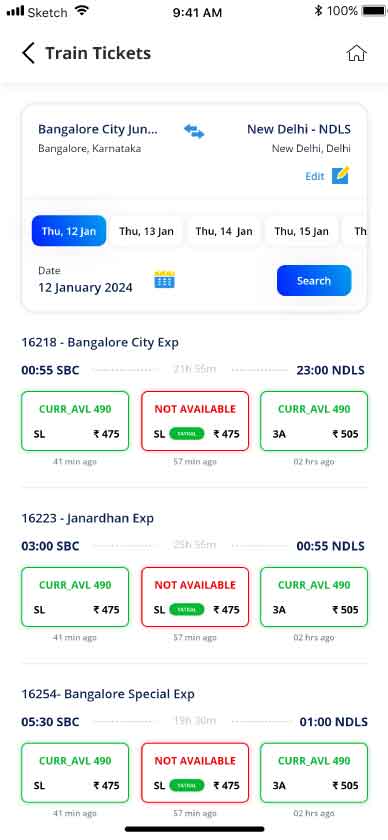

Users can search for train tickets, check availability, view fares, and make bookings directly within the app.

Users can search for train tickets, check availability, view fares, and make bookings directly within the app.

API-Driven Processing:

Transactions are routed securely through APIs exposed by the IRCTC platform to retrieve real-time train information, availability, and fare details from IRCTC.

Transactions are routed securely through APIs exposed by the IRCTC platform to retrieve real-time train information, availability, and fare details from IRCTC.

Response Handling

The backend processes IRCTC’s responses and presents them seamlessly to the user within the app.

The backend processes IRCTC’s responses and presents them seamlessly to the user within the app.

Benefits for the Bank

The integration of IRCTC services within the Banking SuperApp has helped the bank boost customer engagement, drive app usage, and open the door to new revenue opportunities—while aligning with the needs of its digital-first consumer base.

- Enhanced Customer Engagement:

The app becomes a daily hub for users, increasing frequency of usage and creating more touchpoints for engagement. This continuous interaction fosters loyalty. - Targeting Younger Demographics:

Millennials and Gen Z, who are accustomed to seamless, integrated digital solutions, are more likely to choose and remain loyal to banks offering such services that align with their lifestyle preferences. - Cross-Selling Potential:

The integration creates new revenue streams through targeted financial products such as travel insurance and travel-specific credit cards. Customers booking tickets and planning travel are ideal candidates for these offerings, enhancing the bank’s ability to cross-sell relevant products. - Exclusive Offers:

Going forward, customers can access special discounts, cashback, and exclusive travel-related offers, further incentivizing them to use the app for all their travel and financial needs.

Transforming Banking into a Lifestyle Platform

Given the significant consumer spending on travel, integrating IRCTC services within its SuperApp helps the bank to align with the preferences of Millennials and Gen Z, who prioritize convenience and digital-first solutions. This forward-thinking strategy leverages the rapidly expanding travel ecosystem—an essential component of modern consumer spending—while strengthening the bank’s role as a lifestyle partner for tech-savvy users and advancing its digital transformation goals.

Explore More

We empower banks and payment aggregators to achieve success at every step of the transaction journey